Global S&T Development Trend Analysis Platform of Resources and Environment

| Coal’s US downfall is a lesson for power markets | |

| admin | |

| 2020-05-14 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Coal mine in Dhanbad, India. Photo by Nitin Kirloskar, Wikimedia Commons.

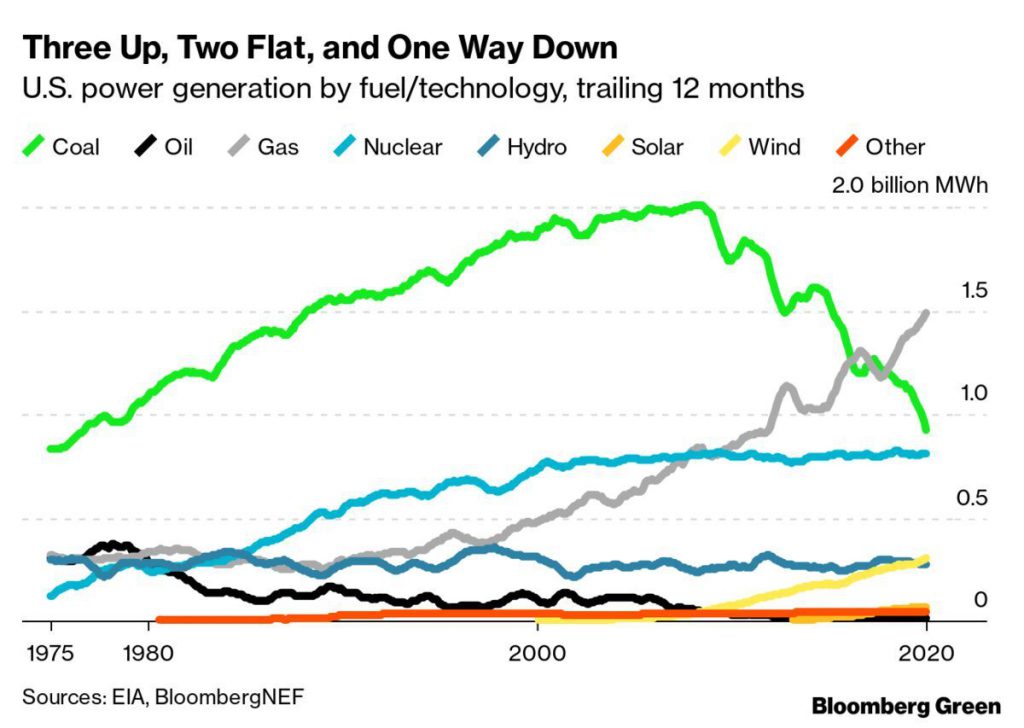

Imagine that you’re a power engineer in 1975, designing and building the U.S. electrical grid. Coal is undoubtedly king, generating nearly three times as much as gas, oil, or hydropower. Nuclear power is a much smaller contributor, and there’s basically nothing else. Now imagine a time-traveling engineer from 2020 shows up and tells you that in 45 years nuclear power will be equal to coal, or even exceed it. It would make sense, right? Power demand is growing; nuclear is the technology of the future, and while coal generation could more than double in several decades, nuclear generation will probably increase 20-fold. Now imagine the visitor showing you the chart below, showing how it played out. You’d likely be stunned.  The chart seems to tell a story about the US energy mix, one about coal and oil’s potentially terminal decline alongside the recent rise of renewables such as wind and solar. Nuclear power generation increased about seven times over from 1975 to the mid-2000s, and has been flat since. Coal peaked in 2007 and has since declined by nearly half. Gas, a resource on par with oil and hydro, has handily passed coal in total generation. Wind power also helped erode coal’s position and has now eclipsed hydro, which has been flat for decades. Though barely visible on this chart, the impact of solar is already being felt.

Back in the present day, in another market where coal was once king, a different transformation is taking place. India’s coal-fired power generation is growing, but it’s not growing per the expectations of planners and builders. The nation’s total coal fleet is at all-time low capacity utilization, i.e. the hours it operates compared to its theoretical maximum. The result? A record stockpile of coal—more than 50 million metric tons worth.That’s more than a month of stored demand, up from only five days in late 2017. The reason for the precipitous drop is multifaceted. Competition from hydropower, wind, and solar is growing. There’s an abundance of operational coal plants. Most importantly, there’s low demand, especially given the nationwide shutdown due to the ongoing Covid-19 pandemic. India’s emissions recently fell for the first time in decades. Nevertheless, BloombergNEF expects India to add about 170 gigawatts of coal-fired generation in the next three decades. In that same time, it will add 1,600 gigawatts of wind and solar. Combined, those renewables will generate more power than coal by 2050. In other words, India today looks much like the US did 45 years ago. And just as in the US way back when, there were challengers if you knew where to look. (By Nathaniel Bullard) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/251599 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Coal’s US downfall is a lesson for power markets. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论