Global S&T Development Trend Analysis Platform of Resources and Environment

| Covid-19 robs diamond sector of recovery hopes | |

| admin | |

| 2020-04-01 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  No sparkle for the diamond sector after hopes of 2020 recovery. (Image courtesy of De Beers Group via Instagram)

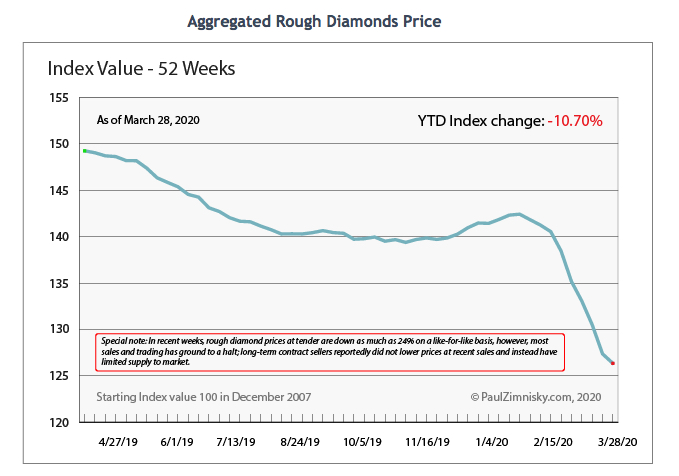

The rapidly-spreading coronavirus pandemic has squashed diamond miners’ dawning hopes of a recovery in a sector that has been severely hit by weak prices and demand since late 2018. The market began suffering from the effects of the covid-19 spread in early March, and measures to contain it have already pushed De Beers, the world’s largest producer by value, to cancel its April sales event. Russia’s Alrosa, the world’s no.1 producer by carats, is studying options for online trade as global travel restrictions make traditional physical inspection of gemstones almost impossible.

Smaller producers, however, have been forced to make more extreme decisions, suspending guidance for the year and halting operations. Mines in South Africa, Canada and Lesotho have been put on care and maintenance for at least a few weeks to stop the spread of the virus. According to VTB Capital’s estimates, increasing mining disruptions put at risk 2.5% of the rough diamonds supply expected for the year. Canada’s Lucara Diamond (TSX:LUC) said on Wednesday it continued to operate, but noted the extent of how covid-19 might change the business landscape was impossible to judge. The Vancouver-based company also suspended production and sales outlook for the year. It had guided recoveries of between 370,000 to 420,000 carats for 2020. Sales had been estimated at between 350,000 to 390,000 carats, generating $180 to $210 million in revenue. “The global diamond industry is experiencing the widespread impacts of covid-19 throughout the value chain, manifested as fewer sales, weaker pricing and production curtailments at several mines,” chief executive Eira Thomas said in the statement.

“Though the Karowe diamond mine continues to operate according to plan, and the first quarter 2020 sale achieved results within expectations, the full impact of covid-19 on our business remains uncertain,” Thomas said. Petra Diamonds (LON:PDL) also had to halt its production outlook for fiscal 2020 after closing its mines in South Africa for a mandatory 21-day lockdown aimed at tackling the worsening coronavirus pandemic. Ruby and emerald miner Gemfields (LON: GEM), which returned to the London Stock Exchange in February, has suspended “all but critical operations” at its Kagem mine in Zambia and cancelled an upcoming auction.  Rough diamond supply disruptions are mounting and might be amplified by precious metals and gems repository Gokhran’s slated acquisition of between $0.5 and $1 billion Alrosa’s rough diamonds this year, said Dmitry Glushakov, VTB Capital’s head of metals & mining research. The cuts, however, are not enough to help the market swing to undersupply, according to Liberum analyst Ben Davis. Davis said output cuts would reduce supply by around 12% and that, even if prices go up as a result, small miners remain in dire straits. |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/231188 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Covid-19 robs diamond sector of recovery hopes. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论