Global S&T Development Trend Analysis Platform of Resources and Environment

| Africa’s biggest fund manager sees gold boom in West Africa | |

| admin | |

| 2019-08-15 | |

| 发布年 | 2019 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Obuasi is one of Africa’s largest gold mines. (Image courtesy of AngloGold Ashanti)

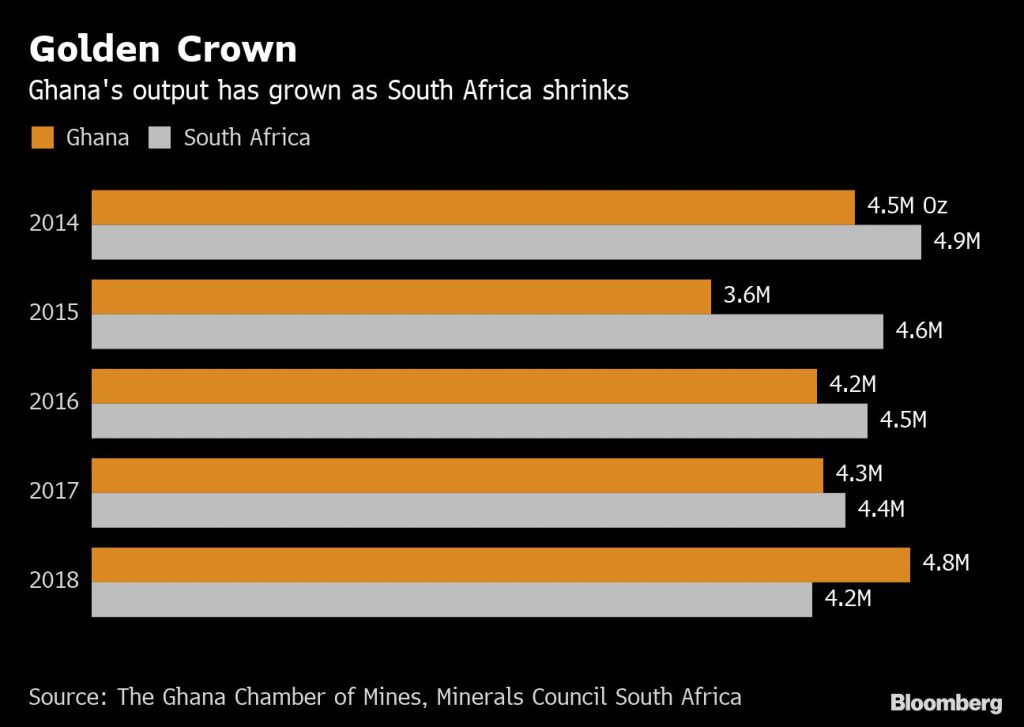

Africa’s largest money manager sees “significant investment opportunities” in West African gold mining as the industry at the southern end of the continent declines. Investor-friendly policies can help Ghana and other countries in the region drive the next “gold-mining boom,” said Lebohang Sekhokoane, a mining research analyst at South Africa’s Public Investment Corp. Low-cost deposits in Mali, Burkina Faso, Guinea and Ivory Coast offer the long-term investment potential the PIC prefers, rather than the five to 10-year lifespan of projects in South Africa, she said. “When you look at the gold sector in West Africa, that’s where the sun is rising,” Sekhokoane said in an interview on Wednesday in Johannesburg. “We expect to see more opportunities from West Africa.”  The PIC, which oversees about $150 billion of assets for more than 1.2 million South African state workers, doesn’t yet have any unlisted mining investments in the continent outside its home nation. The money manager can invest as much as 5% of its assets in such unlisted African projects across all sectors. “Opportunities do exist and focus is shifting to other parts of the continent,” Sekhokoane said. “We obviously like to fund longer-term projects.” South Africa’s gold industry, which has produced half the world’s bullion ever mined, has been shrinking amid the geological challenges of exploiting the world’s deepest mines. AngloGold Ashanti Ltd. and Gold Fields Ltd. have shifted production to lower-cost operations, including West Africa, with the former in the process of selling its last underground mine in South Africa.

Both companies are expanding output in Ghana, which has leapfrogged South Africa to become the continent’s largest bullion producer. Gold Fields said production from the West African country jumped by 25% in the first half, while AngloGold Chief Executive Officer Kelvin Dushnisky has called Ghana’s Obuasi mine “an engine for growth.” Gold Fields is considering extending the lives of its Tarkwa and Damang mines in Ghana, where high volumes compensate for lower ore grades. “We wouldn’t be afraid to put more money in Ghana,” Gold Fields CEO Nick Holland said on Thursday. “It’s a premier gold mining destination here in Africa. We think there is still massive potential there.” While the South African government has fixed some regulatory issues, there is “little incentive” to invest in the country’s gold mines, according to the PIC, which owns shares in both the Johannesburg-based producers. “The South African sector is mature,” Sekhokoane said. “Compare that to new opportunities in West Africa where operations are shallower, making it easier to mine and there is an investor-friendly environment.” (By Felix Njini) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/219589 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Africa’s biggest fund manager sees gold boom in West Africa. 2019. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论