Global S&T Development Trend Analysis Platform of Resources and Environment

| Uranium still drawing investors as SEC rejects Sprott US fund | |

| admin | |

| 2022-04-29 | |

| 发布年 | 2022 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Stock image.

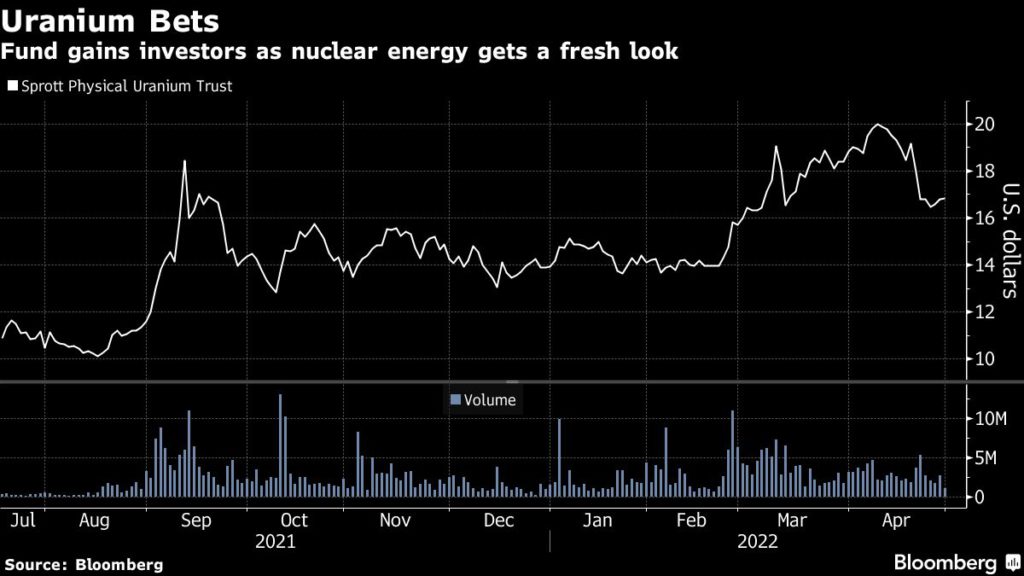

Commodities investors see uranium as a rising star, a material needed for nuclear power in a world moving away from fossil fuels. For the U.S. Securities and Exchange Commission, investing in it is another story. The SEC this week rejected an application by the Sprott Physical Uranium Trust to become the first such fund to trade on U.S. exchanges, the company said, citing a failure to meet listing standards. A Sprott statement pointed to challenges including the structure of the trust “and the nature of the physical uranium market.” Think about it: how would redemption and delivery of radioactive material work? Usually a failed U.S. listing is cause for concern. Not so for Sprott, or investors and analysts tracking the company’s Canadian-listed physical uranium trust, started in July and now at $3 billion in assets. “We’ve been very clear to our investors from the start that this would be treated as a novel listing by the SEC thereby making it difficult to predict an outcome,” said John Ciampaglia, chief executive officer of Sprott Asset Management, the investment manager to the trust, by email. “We acknowledge the uranium market has a number of structural differences compared to other commodity markets.” Ciampaglia said the trust does not currently intend to further pursue a listing of its units on a U.S. stock exchange in the near term but “will remain an active participant in this evolutionary process.” When the Sprott trust launched, the price of uranium was around $30. Now, the radioactive metal has jumped 76% to about $53, according to data from Numerco, a U.K.-based nuclear fuel brokerage.  The Global X Uranium ETF (ticker URA), an exchange traded fund often used as a proxy for spot uranium prices, has gained 1.6% this year after a 48.9% jump in 2021. The fund invests in uranium miners and related companies. The NorthShore Global Uranium Mining ETF (ticker URNM), another uranium U.S.-listed fund, rose 1.6% year-to-date and rallied 67.8% in 2021. So investors clearly are excited about the prospects for all things uranium, which is why some analysts saw the Sprott trust listing in the U.S. as promising. “If they can somehow figure out a way to do this, it should be a smash hit product because this country and the rest of the world is really opening up to the reality that nuclear energy will have to be part of the climate change solution,” Bloomberg Intelligence’s Eric Balchunas said. “The sentiment has totally changed.” A lack of a U.S. listing will not be a major hindrance to the trust nor to the broader uranium market, according to Arthur Dwight Hyde, portfolio manager at Segra Capital Management, a hedge fund dedicated to investing in the nuclear industry. “The SEC’s reaction to the proposal was always a wild card,” Hyde said by email. “Given Sprott’s success in raising capital over the last nine months, and the vehicle’s liquidity today, we do not believe its Canadian listing is a limiting factor for institutional ownership.” Sprott has scooped up roughly 55 million pounds of uranium since the summer, which is roughly 42% of the annual mine production. The haul is valued at about $2.9 billion as of April 28. (By Isabelle Lee and Emily Graffeo, with assistance from Yvonne Yue Li) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/348481 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Uranium still drawing investors as SEC rejects Sprott US fund. 2022. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论