Global S&T Development Trend Analysis Platform of Resources and Environment

| Volatility rages in uranium stocks as clean tech takes a beating | |

| admin | |

| 2022-02-02 | |

| 发布年 | 2022 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  McArthur River uranium mine, Canada. (Image from Cameco)

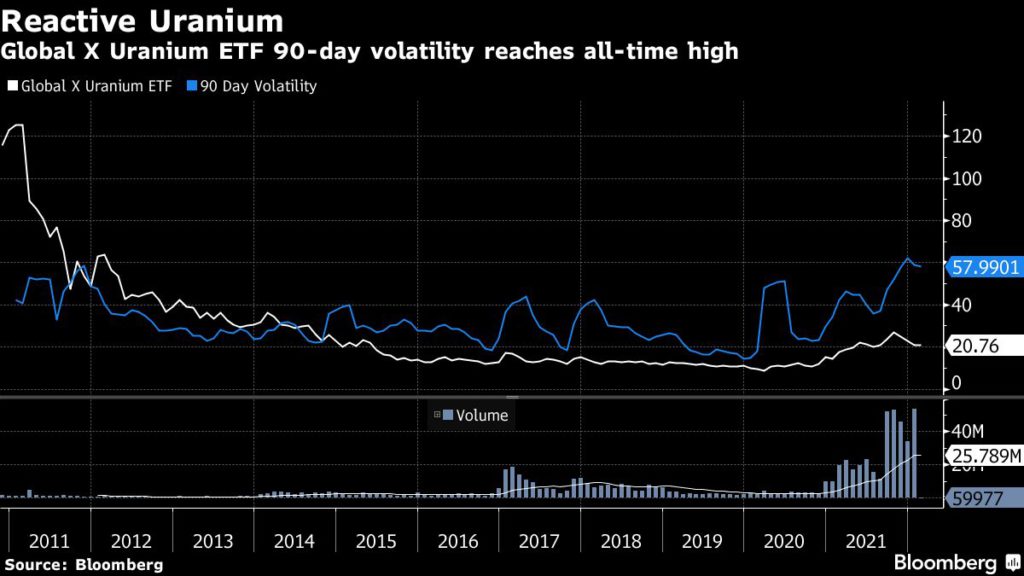

Uranium is a highly volatile investment even in the most ordinary times. But January has been far from normal for uranium, pushing volatility in the stocks to a new level. Unrest in Kazakhstan, the world’s top uranium-producing region, and proposals in Europe to label nuclear energy sustainable triggered a blistering start to 2022 for uranium miners. But since then, a rout in clean tech has set in, sending the iShares Global Clean Energy ETF down 11% in January. Suddenly, uranium stocks are the worst performers on the S&P/TSX Energy Index year-to-date, and all of the companies in the index are down, some more than 10%, while the broader energy index is up 12%. As a result, the 90-day average volatility for the $1.1 billion Global X Uranium ETF reached a new high in January, according to Bloomberg data. Meanwhile, volatility in individual stocks like Cameco Corp., North America’s largest uranium miner, are at seven-month peaks. The stock rose 1.5% as markets opened Tuesday to C$25.06, well off its 52-week high of C$34.97 set in November.  “A lot of the volatility was mostly driven by the flow of funds out of small-cap tech, which uranium names were caught up in,” Cantor Securities analyst Mike Kozak said. Granted, January was a volatile month for all stocks, with the Cboe Volatility Index, or VIX, rising to almost 32 after starting the month at around 17. Looking at fundamentals, Kozak said “the supply/demand macro backdrop on uranium has never been this good.” As uranium becomes increasingly associated with clean energy, funds have flocked to miners like Cameco. It’s now listed on specialized indexes for investors focused on emissions reduction, like the Solactive ISS ESG Screened Paris Aligned Global Market Index, S&P/TSX 60 Fossil Fuel Free Canadian Dollar Index and IStoxx Univest Sustainable World Index. Cameco declined to comment on the price action in uranium stocks, citing its upcoming earnings report on Feb. 9. Last year, Sprott Asset Management launched the world’s first uranium physical trust with an offering of up to $300 million, which CEO John Ciampaglia said was taken up by investors in under a month. The trust now has almost $2 billion in assets. “We would never have forecast the interest that we’ve seen globally when we launched the fund back in July,” Ciampaglia said. (By Geoffrey Morgan) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/345410 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Volatility rages in uranium stocks as clean tech takes a beating. 2022. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论