Global S&T Development Trend Analysis Platform of Resources and Environment

| Tianqi Lithium returns to annual profit thanks to battery boom | |

| admin | |

| 2022-01-26 | |

| 发布年 | 2022 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Greenbushes spodumene mine in Western Australia. Image: Talison Lithium

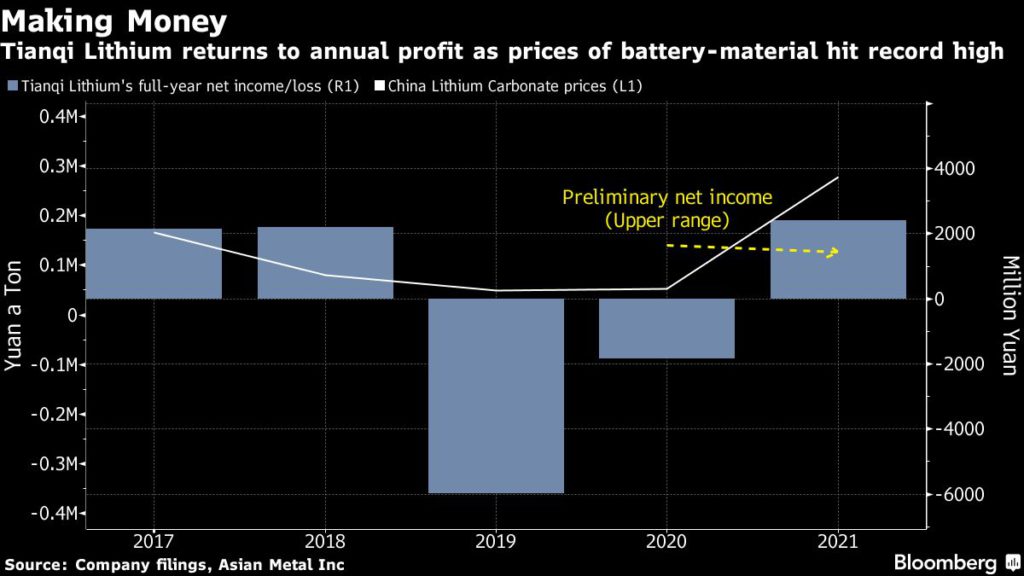

Tianqi Lithium Corp., the Chinese battery-material supplier that’s planning to list in Hong Kong, will return to profitability for the first time in three years due to surging electric-vehicle demand. The company said late Wednesday it expects preliminary full-year net income of 1.8 billion yuan to 2.4 billion yuan ($284 million to $378 million) for 2021. It cited capacity expansions by battery manufacturers, higher lithium product prices and sales volumes, and improved investment income from miner Sociedad Quimica y Minera de Chile as reasons for the result. The official figures are likely to be released in late April.  Chinese lithium carbonate prices have been on a tear, jumping by almost a third this year after surging more than 400% in 2021. The global push toward an electrified transport fleet has fired up consumption of the battery material and supplies are struggling to keep pace. The resurgence in demand helped Tianqi make a profit for three quarters in a row last year, after suffering seven consecutive quarterly losses. It made a 1.8 billion yuan loss in 2020 amid debt repayment pressures that forced it to sell part of its stake in the Greenbushes mine — the world’s largest lithium project — in Western Australia.

First-quarter earnings should continue to be supported by higher lithium carbonate prices, Daiwa Capital Markets analysts Dennis Ip and Leo Ho said in a note. However, Tianqi will likely see a sharp increase in the cost of spodumene — a lithium-bearing raw mineral — under an annual price adjustment mechanism, they said. Tianqi, whose shares already trade in Shenzhen, is reviving a plan to list in Hong Kong. The lithium supplier is working with China International Capital Corp., Morgan Stanley and CMB International on a share offering that could take place as soon as mid-2022 and may raise $1 billion to $2 billion, people familiar with the matter said earlier. Shares of the company rose as much as 6.8% on Thursday in Shenzhen. (By Annie Lee) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/345397 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Tianqi Lithium returns to annual profit thanks to battery boom. 2022. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论