Global S&T Development Trend Analysis Platform of Resources and Environment

| Copper price rises as Chile fuels long-term supply concerns | |

| admin | |

| 2021-05-18 | |

| 发布年 | 2021 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Spence copper mine in the North of Chile. (Credit: Consejo Minero)

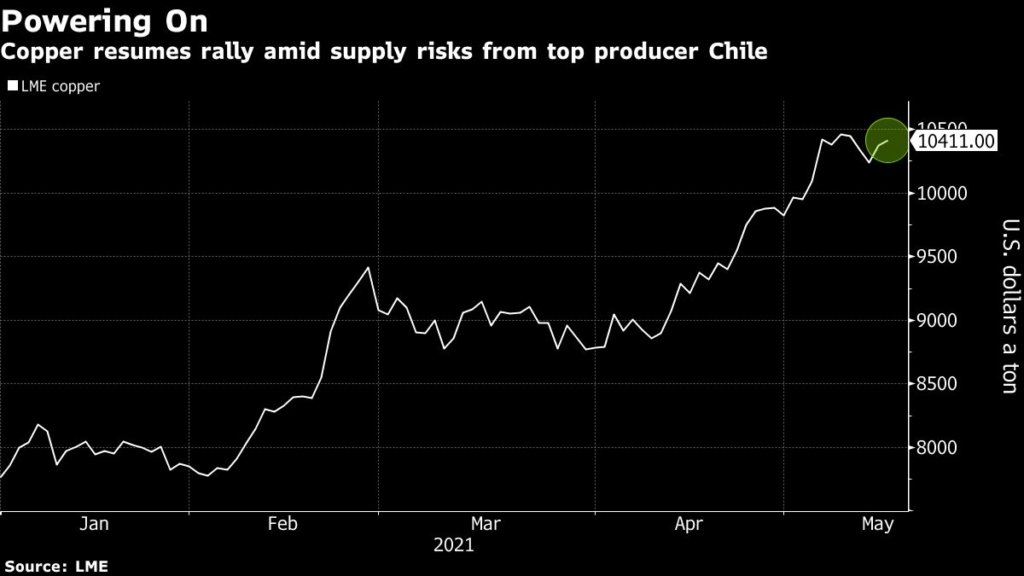

Copper rose toward another record as the potential for tighter regulation and higher taxes in Chile fuels concerns about the long-term supply outlook. The world’s biggest copper producer just elected an assembly that places the writing of a new constitution largely in the hands of the left wing. The makeup is likely to leave miners facing tougher rules around the environment and mineral rights, and it could add momentum to a bill that would create one of the heaviest tax burdens in the global industry. Workers at BHP’s Escondida and Spence mines rejected BHP’s final wage offer on Friday, with almost 97% of the union’s members opting to strike, sparking more immediately supply disruption concerns. Canada’s Teck Resources sees little risk of higher taxes in Chile due to a stability agreement that shields the company’s massive Quebrada Blanca Phase 2 copper project from higher levies for 15 years, Chief Executive Don Lindsay said on Tuesday. In Peru, socialist presidential candidate Pedro Castillo said on Sunday night he would raise taxes and royalties on Peru’s key mining sector and renegotiate the tax contracts of large companies if elected to high office next month. Click here for an interactive chart of copper prices Copper for delivery in July was up 0.35% midday Tuesday, with futures trading at $4.7270 per pound ($10,399 a tonne) on the Comex market in New York.  Copper had stumbled with other industrial materials after climbing to a record last week as China stepped up efforts to cool the commodities surge that’s fanning fears of global inflation. Citigroup Inc. recommended buying on the dips as Beijing could “easily run out of options” to contain costs without making a U-turn in the ongoing domestic production crackdowns for environmental, energy, and safety control purposes. “We do not foresee such a U-turn any time soon given the strategic priority of these agendas,” analysts including Tracy Liao wrote in a note. The country’s measures to rein in prices appear “temporary,” with potential exhaustion of policy options likely resulting in another round of commodity price rallies, fueled by solid end-use global demand and continued domestic supply curbs in some commodities, they wrote. The aluminum threatCopper is the major metal par excellence in terms of electrical conductivity but is not the only solution to energy transmission. While aluminum’s conductivity is some 40% below that of copper it does possess attractive properties – not least its density, which is just 30% of that of copper. This means that an aluminum cable is around 52% of the weight of a copper cable with the same conductivity, a property offering handling, and installation benefits. “Too many forecasts ignore the fact that aluminum is a serious competitor to copper in a number of high volume applications, including high- and mid-voltage power cable, busbars, transformer windings and motor windings,” says Julian Kettle, Wood Mackenzie Senior Vice President, Vice-Chair Metals and Mining.

According to Kettle, even if forecasts of $15,000-$20,000 per tonne for copper prove prescient, without commensurate aluminum prices of $5,000-7,000 per tonne copper would see massive demand destruction, which would be accompanied after some time lag by supply growth.

(With files from Bloomberg)

|

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/326026 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Copper price rises as Chile fuels long-term supply concerns. 2021. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论