Global S&T Development Trend Analysis Platform of Resources and Environment

| Gold price: 2020 ETF inflows set new record | |

| admin | |

| 2020-10-08 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Image: Generation Grundeinkommen

Gold prices steadied on Thursday as uncertainty surrounding the US presidential elections and increased hope of a new stimulus helped to offset the downward pressure on bullion from a higher dollar and improved appetite for riskier assets. Spot gold was little changed at $1,888.13 per ounce by noon EDT, flipping back and forth between positive and negative territory since market open. US gold futures rose slightly by 0.2% to $1,893.70 per ounce. While there is a “pretty robust increase in risk appetite,” with a higher dollar also weighing, inflation expectations are keeping gold supported, Bart Melek, head of commodity strategies at TD Securities, told Reuters:

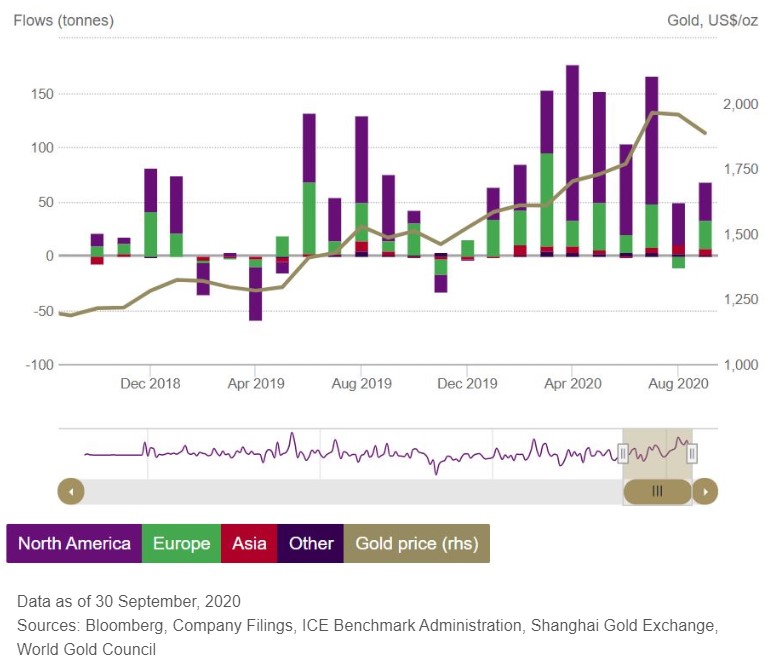

Meanwhile, the global equities market is headed for a one-month high as hopes for more stimulus offset Europe’s rising numbers of coronavirus cases and lockdowns, keeping gold in check. Bullion is still up 24% so far this year, owing to unprecedented government and central bank stimulus worldwide to revive economies, as it is viewed as a hedge against inflation and a safe haven asset during economic and political uncertainties. “It’s going to move higher, it’s going to be volatile. That’s going to be true for the next month going into the election, it’s going to be true for the two months after the election,” Jeffrey Christian, managing partner of CPM Group, told Reuters. Gold ETF milestoneDespite gold prices being subdued by a strengthening dollar and the shift in investor attention towards riskier assets, global holdings in gold-backed exchange-traded funds (ETFs) and similar products remains high. According to the latest report from the World Gold Council (WGC), total ETF holdings worldwide rose for the tenth consecutive month in September, surpassing the 1,000-tonne mark for the first time ever in a calendar year.  By the end of September, gold ETF holdings increased by 68.1 tonnes ($4.6 billion) — or 2% of assets under management (AUM) — despite bullion’s worst monthly performance since November 2016. Global net inflows of 1,003 tonnes ($55.7 billion) in 2020 have led overall gold investment demand and taken the gold ETF holdings universe to a fresh new all-time high of 3,880 tonnes and $235 billion in AUM, the Council notes. Regionally, North American funds led the way again in September with inflows of 34.6 tonnes ($2.2 billion). European funds added 26 tonnes ($1.9 billion), while Asian funds added 6.8 tonnes ($432 million) as two new funds launched in China for a second straight month, bringing the total number of new funds in Asia to seven this year. Collectively, gold ETF AUM has grown about 67% year-to-date through September. (With files from Reuters)

|

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/298341 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Gold price: 2020 ETF inflows set new record. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论