Global S&T Development Trend Analysis Platform of Resources and Environment

| SQM posts record sales, boosts output despite weak market | |

| admin | |

| 2020-08-20 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Brine pools and processing areas at SQM’s lithium mine on the Atacama salt flat. (Image courtesy of SQM)

Chile’s SQM (NYSE: SQM), the world’s second largest lithium producer, achieved record second-quarter output levels and saw sales volumes soar on renewed optimism about long-term demand for the metal used in the batteries that power electric vehicle batteries and high-tech devices. The company said it is now producing at record levels of roughly 70,000 tonnes for the year, which has allowed it to build higher levels of inventory ahead of an expected demand boom. “Given the demand growth expectations in coming years, we feel comfortable with the higher level of inventories that are being built,” it said.

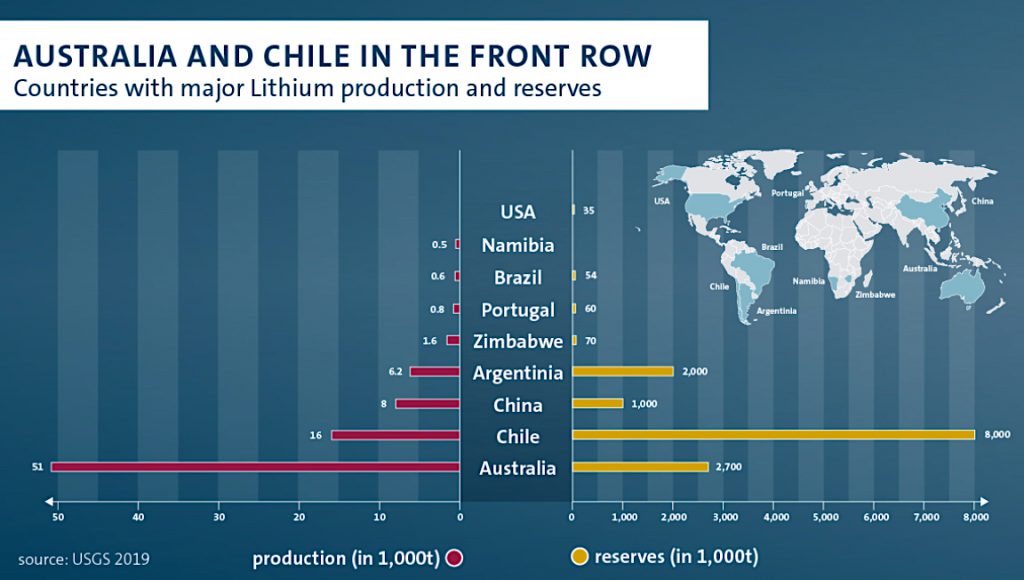

SQM also sold more lithium in the three months to June 30 than in the first quarter, delivering 12,600 tonnes of the white metal, up 45% from the January-March period. Weak lithium prices, however, impacted SQM’s bottom line. The Santiago-based miner saw net income fall to $50.8 million, a 27.6% drop when compared to the same period last year. “We believe that prices will be lower during the second half of the year compared to the prices observed in the first half of the year, although sales volumes should be higher,” chief executive Ricardo Ramos said in a statement. While the company expects demand in 2020 to be similar to 2019, it remains optimistic about long-term demand growth because of increasing expectations for car sales, EV penetration rates and continued government incentives. Under scrutinySQM produces lithium by pumping brine from beneath the Atacama desert, the world’s driest, which it concentrates through evaporation in pools. In 2016 Chile’s environmental regulator SMA found that SQM had extracted more brine from the salt flat than permitted. A $25 million compliance plan presented by the company was dismissed by a court in Antofagasta in December. Despite the company’s appeal, SMA sided in early August with the regional court. The regulator is currently re-evaluating SQM’s plan. Water has become a bone of contention for the expansion plans of both SQM and top competitor Albemarle (NYSE: ALB), both of which operate in the Atacama desert, where more than a third of global lithium carbonate supply is sourced. Chile, which holds about 52% of the world’s known lithium reserves, lost its top lithium producer crown to Australia in 2018.  The country, however, is working on reversing that situation. It predicts that lithium will soon become its second-largest mining asset, behind copper. The commodity is currently the country’s fourth-biggest export. SQM’s own expansion plans are on track to be completed by the end of 2021, the company said. |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/290533 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. SQM posts record sales, boosts output despite weak market. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论