Global S&T Development Trend Analysis Platform of Resources and Environment

| Commodity freighters are shrugging off covid-19 for now | |

| admin | |

| 2020-07-02 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  Stock image.

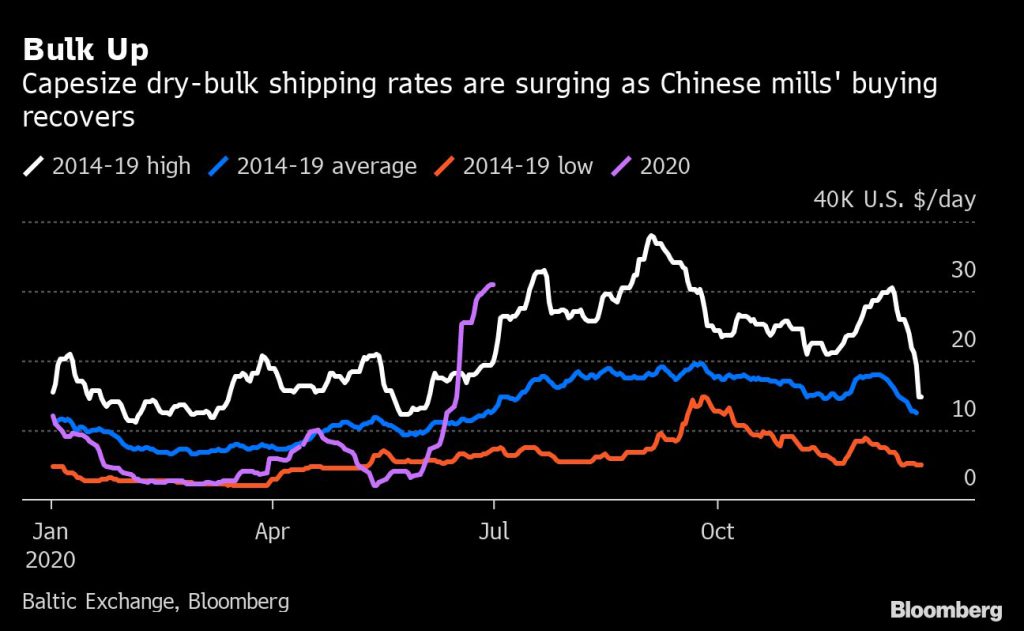

The cost of moving commodities like coal and iron ore across the world’s oceans is surging as China lifts cargo purchases. Whether the rally will withstand the economic aftershocks of the coronavirus is a thornier question. Rates for giant capesize ships climbed to almost $31,000 a day on Wednesday, almost certainly the highest for the time of year since 2009. The rally has been driven by an increase in cargo flows from Australia and Brazil, the two top iron ore producers, as easing lockdown measures saw Chinese steel mills increasing purchases.  “There is strong demand from China, with steel production up 5% year-on-year in June,” said Frode Morkedal, an analyst at Clarkson Securities Ltd., a unit of the world’s biggest shipbroker. “Port inventories of iron ore are relatively low, so steel mills and traders are replenishing stocks.” Steel output in China jumped to a record 92.27 million tons in May, according to the nation’s statistics bureau. The country accounts for 62% of the world’s production of the alloy. That’s helped draw in iron ore cargoes in a market where supplies had previously been constrained after judges shuttered mines due to Covid-19 infections in Brazil. Iron ore shipments from Australia including Port Hedland hit a record 21.1 million tons in the week to June 26, according to Global Ports data compiled by Bloomberg. Longer runIn the longer run, the shipping market’s fortunes will be heavily linked to how China sustains its economic revival while the pandemic continues to spread — especially if other nations take longer to recover. China’s steel industry takes in about 70% of the world’s seaborne iron ore and its grip on global consumption is strengthening in 2020. After the first wave of virus controls were eased, demand surged as property developers caught up on lost time. The authorities also ordered an acceleration in infrastructure projects to battle the economic slump. The country’s broader economy is making only a tentative recovery though, and a flurry of fresh Covid-19 cases in Beijing should serve as a reminder of just how fragile that comeback could be. For the time being, though, freight prices are still rallying. “The recovery is underway with Capesize spot rates well above our expectations for the summer,” said Randy Giveans, senior vice president for equity research at Jefferies LLC in Houston. “Most of the strength is due to increased Chinese steel mill demand for iron ore, low iron ore inventories, increasing production and exports out of Brazil.” (By Firat Kayakiran, with assistance from Jason Rogers) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/281631 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Commodity freighters are shrugging off covid-19 for now. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论