Global S&T Development Trend Analysis Platform of Resources and Environment

| Gold buyers are forking over lofty $135 premiums for US coins | |

| admin | |

| 2020-04-27 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

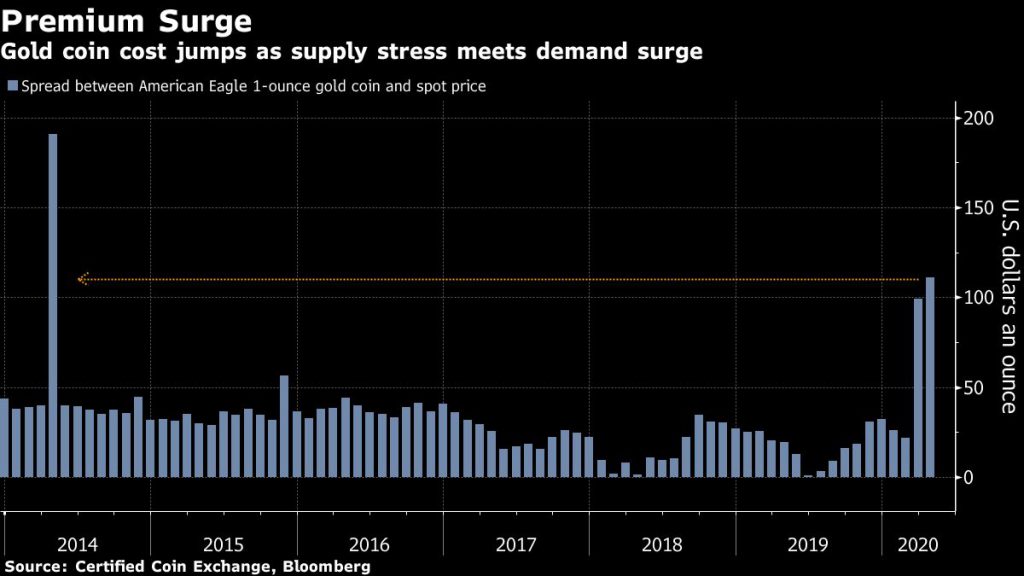

| 正文(英文) |  Gold coin premiums are at the highest levels in six years. Image: U.S. Mint

Retail investors can’t seem to get enough of gold during the coronavirus crisis, and they are willing to pay staggering amounts to get their hands on it. Consumers who want to buy gold coins typically have to pay more than the per-ounce prices quoted on financial markets in London and New York. That premium has jumped to $135, more than tripling from two months ago, said Robert Higgins, chief executive officer at Argent Asset Group LLC in Wilmington, Delaware. “There has never been a time for American Gold Eagles at this premium level,” Higgins said in an interview, referring to the popular U.S. bullion coin. The surge is being exacerbated by coronavirus-related lockdowns, which have led to a squeeze in the supply of coins and bars available for shipment around the globe. At the same time, bullion’s status as a haven is luring investors rattled by worldwide market and economic turmoil. “Until the world catches up with the imbalance and gets back to a normal balance of supply and demand, the premiums will stay,” Higgins said.  Gold-coin premiums tracked by Certified Coin Exchange are at the highest levels in six years, data from the bourse show. Last year, bar and coin demand fell by 20% to the lowest level since 2009, hurt by costlier prices that discouraged retail bullion buying globally, according to the World Gold Council. That began to reverse in 2020, with investors snapping up coins sold by the U.S. Mint in March at the fastest pace in over three years. Higgins, a 40-year industry veteran, operates a wholesale business that typically deals with an average of 1 million to 1.5 million ounces of gold each month. That jumped to more than 6.5 million ounces in March as premiums surged, he said. As some refiners of the metal resume partial operations, he expects market tightness to subside in coming weeks. Mish International Monetary Inc., a dealer in precious metal bullion and coins, based in Menlo Park, California, has been selling gold coins at highly elevated levels for three to four weeks. The company told customers Thursday it’s offering one-ounce coins in its inventory for a 7% premium, or at almost $1,851 an ounce based on Friday’s closing spot price of $1,729.60. “It’s crazy,” said Mish President Robert Mish. “There is a factor in the market that many of the buyers do not trust the system anymore and want to get their metal in their hands for certain.” (By Justina Vasquez) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/247716 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Gold buyers are forking over lofty $135 premiums for US coins. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论