Global S&T Development Trend Analysis Platform of Resources and Environment

| The US and Europe are getting more anxious about EV battery shortages | |

| admin | |

| 2019-07-08 | |

| 发布年 | 2019 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) |  A drill site at Clean Teq’s Sunrise cobalt-nickel-scandium project in Australia, 350 km west of Sydney. Image courtesy of Clean Teq.

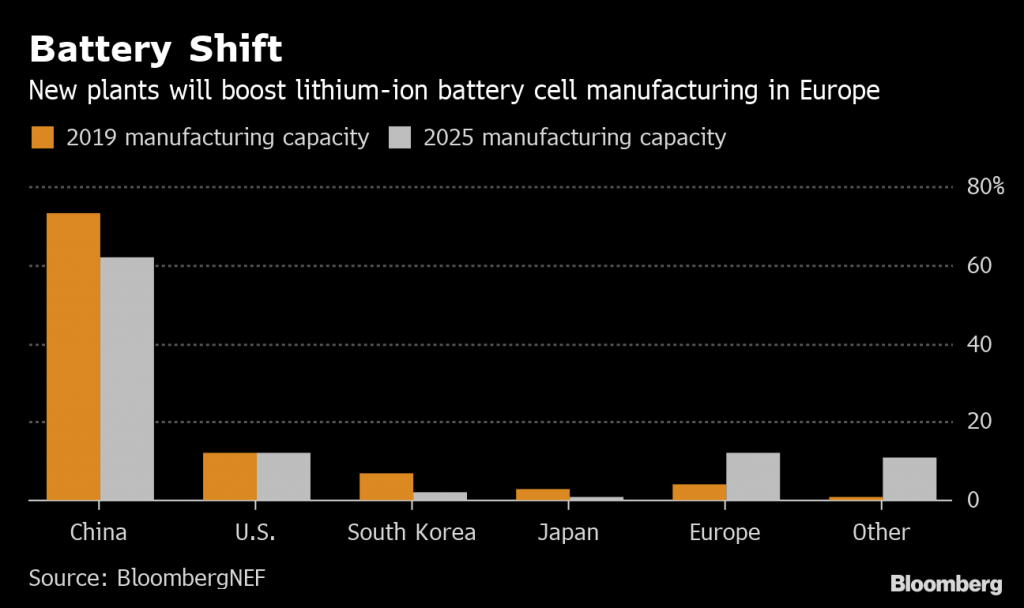

Automakers to trading houses from North America to Europe are becoming more concerned about future supply shortages of key materials needed for electric vehicle batteries as spending on new production soars, according to the developer of a $1.5 billion project in Australia. More than a dozen parties have now expressed interest in taking up as much as a 50% stake in Clean TeQ Holdings Ltd.’s Sunrise nickel-cobalt-scandium project, Chief Executive Officer Sam Riggall said Monday in an interview. They include companies in regions that until recently had shown less impetus to tie up raw material supplies. “It’s dawning on North America and Europe that there’s a raw materials issue that needs to be addressed here,” Riggall said by phone. “For the previous two years, I’ve been wearing out a lot of shoe leather and banging on a lot of doors trying to get interest in Europe and North America with very little success. In the last six months things have changed quite dramatically.” Volkswagen AG in May picked Sweden’s Northvolt AB as a partner to start production of battery cells for electric cars, while the German and French governments have pledged funding and political support for efforts to spur a European battery manufacturing industry. In the U.S., the number of battery electric models available to consumers is forecast to double by the end of 2021, according to BloombergNEF. Melbourne-based Clean TeQ, which said last month it had appointed Macquarie Group Ltd. to run a process to identify a partner, is seeking final offers for a stake in the Sunrise project by the end of September, and will aim to complete any sale by the end of the year, according to Riggall. China’s grip on lithium-ion battery cell manufacturing is forecast to loosen through 2025, as new capacity is added close to demand centers in the U.S. and Europe, BNEF said in a May report.  The scale of planned investments in electric lineups means both automakers and related industries in Europe and North America are focusing on how to secure future supplies of battery-grade nickel — and also on ensuring there’s sufficient cobalt after the market tightens from about 2021 to 2022, Riggall said. “Their minds are being forced to turn to raw materials,” he said. “They are seeing significant risks on that side of the business.” There’s a looming shortage of nickel sulfate, the material used for battery products, with demand forecast to outstrip planned new capacity, BNEF said in a July 2 report. Cobalt demand may also top global supply from about 2025, according to the note. Cobalt prices have tumbled since early 2018 on new supply from incumbent producers in the Democratic Republic of Congo, and as some battery makers seek to reduce the amount of the metal in their packs. Nickel has declined about 11% on the London Metal Exchange in the past year. Clean TeQ is targeting commerical production at the Sunrise project, with a forecast mine life of more than 40 years, from 2022, Riggall said. (By David Stringer) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/219669 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. The US and Europe are getting more anxious about EV battery shortages. 2019. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论