Global S&T Development Trend Analysis Platform of Resources and Environment

| Poor market conditions derail Triple Flag IPO | |

| admin | |

| 2019-12-11 | |

| 发布年 | 2019 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

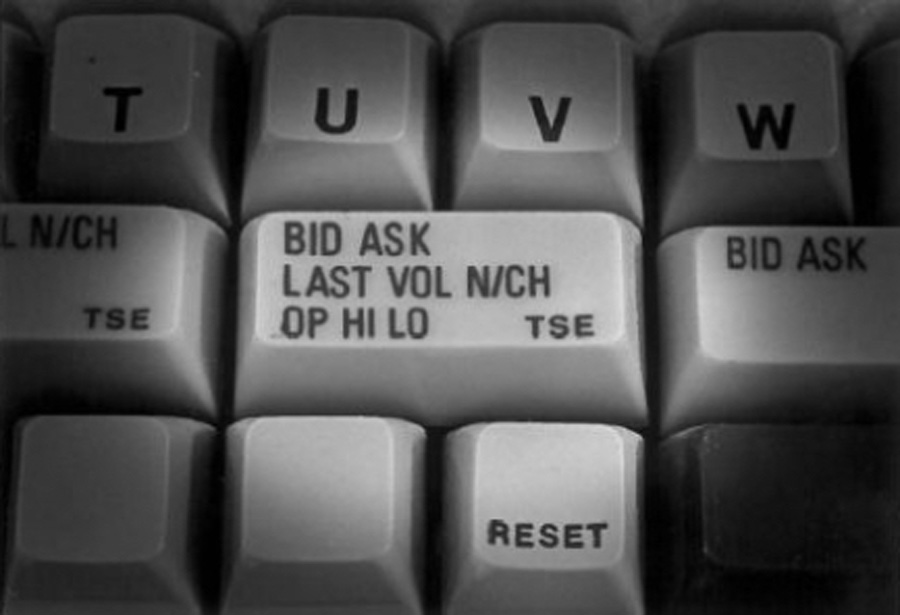

| 正文(英文) |  Close-up of keyboard of Computer Assisted Trading System (CATS) developed by the TSX which went live in 1977. Image: TSX

Royalty and streaming company Triple Flag Precious Metals has cancelled a planned initial public offering due to poor market conditions. “While the company has been encouraged by investor interest in its proposed initial public offering,” Triple Flag said in a statement, “the market environment for share offerings, particularly near year-end, continues to be challenging.” The company had planned to issue 20 million common shares at an offer price of between $15 and $18 per share. At a mid-point price of $16.50 per share, the IPO would have raised about $330 million—which would have made it the biggest mining IPO in Canada in more than 24 months. The proceeds would have been used to acquire royalty, stream, and other interests, and to repay debt.  The company, which has royalties on Kirkland Lake Gold’s (TSX: KL; NYSE: KL) Fosterville mine in Australia and Alamos Gold’s (TSX: AGI; NYSE: AGI) Young-Davidson mine in Ontario, among others, was founded by Shaun Usmar, a former executive at Barrick Gold (TSX: ABX; NYSE: GOLD) from 2014 to 2016, and is backed by hedge fund Elliot Management. Usmar noted in the company’s Nov. 22 IPO prospectus, that since the company was created in 2016, the management team had reviewed more than 400 opportunities and completed 15 transactions. “We believe our thoroughness has paid off in building a portfolio of 37 assets, with geographic and asset diversification, as well as a mix of cash-generating and near-term production assets that we believe will continue cash flow growth in the coming years,” wrote Usmar, who joined Xstrata in 2006 as an early senior executive member of the management team that grew the company into one of the world’s largest diversified miners at the time of its acquisition by Glencore in 2013. Of the 37 assets, eight are metals streams and 29 are royalties. The portfolio includes nine producing mines, five projects in construction, and 23 development and exploration-stage projects. “We didn’t invent the streaming and royalty business model, but we have embraced it for its record of superior performance relative to bullion and gold mining company equities, whether prices are rising, declining, or stable, as evidenced by the equity performance of our peer companies,” the South Africa native outlined in a letter to prospective investors in the prospectus. “The foundational concept of Triple Flag was born out of the idea that the streaming and royalty business model is a compelling way for investors to gain exposure to precious metals, and my belief that a gap in the competitive landscape existed,” he said. “I believed there was room for a capable new entrant to distinguish itself through hard work and effective execution.” Triple Flag declined to comment on the cancelled IPO due to Ontario Securities Commission rules on public communications. (This article first appeared in The Northern Miner) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/219354 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Poor market conditions derail Triple Flag IPO. 2019. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论